If you are taking your company to global markets you need to build relationships with financial intuitions around the world. The capital investments doing business abroad might affect the cash flow of existing operations when is not financed and it stops you building a relationship with banks and financial institutions whom are important players in growing your business. We suggest to consider for all small and mid size companies doing business in U.S to apply for loan for their operations it can be through a bank that located from your home country or a another institution from U.S. our services will guide you to have the best offer at best rates for your loan needs.

If you are taking your company to global markets you need to build relationships with financial intuitions around the world. The capital investments doing business abroad might affect the cash flow of existing operations when is not financed and it stops you building a relationship with banks and financial institutions whom are important players in growing your business. We suggest to consider for all small and mid size companies doing business in U.S to apply for loan for their operations it can be through a bank that located from your home country or a another institution from U.S. our services will guide you to have the best offer at best rates for your loan needs.

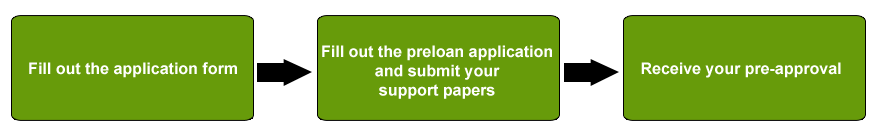

![]() Please right-click on the Apply Now button and select Save As to download the Pre-Loan Questionnaire

Please right-click on the Apply Now button and select Save As to download the Pre-Loan Questionnaire

Advantages

U.S as a largest market for financial industries in the world offer numerous advantages when especially foreign firms choose to work with them especially using their loans and paying them back while successfully growing their business. For instance while doing business in the U.S and having a success will make your firm to decide for going public which requires a capital to invest first to investment bankers, but when working with the banks will make your company go public smoother.

Some of advantages for using business loans

- Tax benefits

- Lower rates

- Availability of loan payment insurance

- Relationship building in U.S with banks

Capabilities

Foreign market entries and its strategies add additional costs for cost of goods sold at your in domestic home market which will decrease your companies profit for short term until the new investment generates profits. Using our business loans will allow foreign companies doing business In the U.S and pay back the capital barrowed in 5 to 10 years meaning instead of paying in 6 months the %100 of the capital for your new market investment your firm will pay the same amount in long term which will have less impact on your company’s balance sheet.

Our capabilities include:

- Joint financing

- Standby Commitments

- Negotiating to Reduce Interest Rates

- Strategic Planning

- Asset Based Loans

- Credit Presentation

- Vehicle, Equipment and machinery leasing

How It Works

FAQs

How soon I can get a pre approval?

It takes around 1 week to get your approval.

Do I pay any application fees and how much?

Yes there are application fees, but it’s hard to determine the amount because it depends on which financial institution we will use and the program you will choose.

How much the interest rates will be around?

For a normal application meaning that all collaterals are presented along with a bank guaranty from your country rates are around %5-%8.

Are there any other alternatives if I can’t get my back to guaranty my U.S loan?

Yes there are for instance loans for a real estate investments will require minimum %30 down payment without a bank guaranty but for business operating expenses you will need a bank guaranty.

After getting the pre approval how long it takes for an official approval?

To get an official approval is also depends on how much official paperwork you will submit meaning all financial reports of your company, business plan and etc. but if you work along with the process after submitting all information it should take 2-3 weeks.

How will the loan payment to be paid to U.S financial institution?

Your U.S bank account will be drafted every 30 days.

After the getting the loan I finis it pay it earlier will it cost me less?

Yes, your monthly statements will include pay off amount for that exact month without an interest.

I do not need a business loan my company is financially healthy to make investment without a loan?

Return to US Market Entry Solutions