Take your company to international level by using our services.

Dealing with Finance & Accounting Issues might be quite challenging for foreign companies internationally or when doing business in the U.S because of complex system and regulations. As well as the costs and fees related to it. We use cost effective services to introduce your firm to U.S and International markets as well creating traditional or none traditional models for your firm.

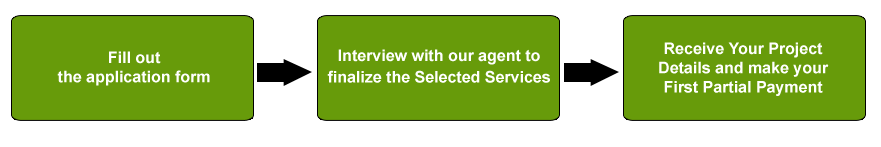

We do advise and prepare your company for the stages that need to be taken for doing business successfully in the U.S and Internationally. Our services are not limited to Accounting and Financial please check in the capabilities section in this chapter to learn more about our other services for foreign companies which provides your firm the efficient tools to do business in the U.S and internationally without leaving your home country. Which we will provide your company affordable International business opportunities as well as Growing at Financial markets. After submitting your application form at how to start section our experts will contact you in order to create the road map and business plan which will add tremendous value to your company.

Advantages

If you are a large or mid size co operation doing business internationally or with the U.S we can assist you to integrate your domestic system into international level, where in today’s global economy will help you to be well known by your potential partners and stock holders abroad.

If you are a large or mid size co operation doing business internationally or with the U.S we can assist you to integrate your domestic system into international level, where in today’s global economy will help you to be well known by your potential partners and stock holders abroad.

As well as assisting you to bring your corporation up to international standards we also assist foreign firms to do direct and indirect businesses in the U.S. Please check our capabilities section for more information.

Accounting Capabilities

Our full service accounting and financing experts will guide you step by step to ensure the delivery of quality transactions.

Please fill out the application form to find out which services are right for your company

Our Capabilities include:

Tax services for businesses and individuals:

If you are a U.S person living abroad or have a business in the U.S you can take advantage of our tax services. Services offered under this category are:

- U.S income Tax Preparation

- International Taxation

- U.S Sales & Use Tax Return Service

- IRS Tax Problems Resolution

Business Valuations:

Having a correct value before acquiring a business or merging is the most important along with other practices. Our team of experts values a business and its assets by using GAAP or IFRS accounting systems. Please ask us more about this practice.

Some of the services included in this practice:

- Visiting the Valuation Location

- Face-to-face meeting with the management team;

- meeting with key customers;

- Investigate comparable public or private companies;

- Benchmark company against industry peers

- Detailed economic report

- Detailed analysis of the company’s financial trends and metrics;

- Considers all three major valuation approaches (Income, Asset, and Market);

CFO Assisting Services

Trying to estimate for the company’s new enterprises For CFO’s and/ or other Senior Executives might be quite challenging while also serving for company’s existence work especially when the company’s goal is to grow in the U.S. Our team provides full serve assisting services to CFO’s without interrupting their daily business activities.

Some of services offered under this category include:

- SWOT Analysis

- Business Process Reviews

- Financial Modeling for new or Existing Enterprises

- Project Funding Strategies

- Business Plan Developments

- Financial Statement Review & Analysis

- Interim Management

- Mergers & Acquisition Activities

- Turnaround Management

IFRS Conversion & Reporting Services

Our affordable IFRS services can introduce any size company to international financial markets, where your company will be more visible to potential investors and partners around world.

Our IFRS services include:

- IFRS Conversions

- Due Diligence In IFRS

- Purchase Price Allocations

- IFRS training

QuickBooks Services

When dealing with clients abroad companies need to use software’s that save you time and understands your unique business, We do suggest QuickBooks software for dealing with your fclients abroad .

OUR QuickBooks service includes:

- Full Set Up

- Training

- Daily and / or Weekly entries

Mergers & Acquisitions Advisory services

Properly executed International M&A strategy can drive your company’s value far beyond its own regular growth. Our team of Experts works closely with your Company’s management and with potential M&A partner in the U.S.

Our Service Includes:

- Identifying and evaluating the opportunities

- Letter of Intent structuring

- Negotiations

- M&A Due Diligence

- Financial Modeling

- Creation of Buy/ Sell agreements or Partnership Agreements

Initial Public Offering Assistance

Preparing for an International IPO might be quite challenging for foreign firms due to the complex market and regulations. We work with industry leader banks and financial institutions to ensure the best result for your company.

Our service Includes:

- Investment Banker Selection & Fee Negotiations

- Investor Relations Management

- Disclosure Programs

- IPO Compliance Services

- Developing Capital Market strategies

- Selection of Strategic Investors

- Meeting with potential Clients for Purchase price Offerings

- Valuation Support

Direct Public Offering Assistance

DPO is an alternative to IPO for small and mid size foreign companies because of the occurring fees and less regulation. In other words selling your shares will be inexpensive through DPO and likewise many companies you can use the funds raised for your future IPO expenses which may cost over a million plus monthly fees.

Therefore to test the market and to be familiar with it we do suggest doing DPO for Foreign Companies.

Our Service Includes:

- Determining if DPO is appropriate for your company

- Strategic Planning

- Preparation of State fillings

- selecting potential investors

- Investor Relations Management

- Business plan Developments

- Meeting with potential Clients for Purchase price Offerings

Reverse Merger Services

Going Public and Have your company listed at U.S Financial Markets such as; NYSE, AMEX, NASDAQ or OTCBB, is quite costly and time consuming it can cost as high as million or more and takes close to a year time but reverse mergers in other words buying out a company whose shares are already publicly traded is inexpensive and quickest way of going public and offer shares at Financial markets. It can be done as little as in 30 days and cost of buying an existing public company could be 5/1 of a regular IPO. Our team of experts works closely with your company management in order to select the public shell company and completing the process of going public in the U.S.

Our Services Include

- Investor Relations Services

- Corporate Image Building

- Marketing

- Due Diligence

- Legal Support

FAQs

We are a Chinese Company and have a plan of going public here in china! What road map should we follow for this new Approach for being successful in our domestic and AT international Markets?

There are numerous advantages of Going Public in Multiple Exchanges in different countries when doing an IPO at first time. Such as confidence of your domestic investors might increase when knowing that is also will be offered to public in the U.S. The road map is depends on each company and its goals. Please ask us about the details of a road map that we can offer.

I am not sure whether to choose the way of going public in the U.S IPO, Reverse merger or DPO?

An IPO and reverse merger (Take Over) are almost the same things, where your company will buy existing public company’s ownership. But DPO is raising almost limited capital which is used for most foreign companies to finance their IPO or reverse mergers.

Are monthly expenses high for being publicly traded in the U.S?

Being publicly traded company in the U.S has certain fees and Labor related issues just like in your own country, our team of experts will design a cost effective way of keeping the expenses down by providing the quality service.

How long our IPO will may take?

The traditional IPO’s might take a year or Longer. But to have a correct executed plan we do suggest up to two years of time with full of objectives and operations to complete not only focusing to U.S financial markets we also guide our clients how to enter to U.S market to sell their products which will also help to raise more capital during public offerings and after.

What are the advantages and Disadvantages of going public for foreign companies in the U.S?

Advantages: Less dilution, Liquidity, International Visibility &reputation

Disadvantages: U.S Legal exposures as well as domestic legal exposure in your home market, increased expenses for having your company publicly in multiple exchanges.

For detailed opinion of Advantages & Disadvantages please submit your application

How Can I determine the right IPO Timing?

IPO timing is different for each sector and depends on many social and economic situations our team of experts will investigate the market for best timing as well using third party opinions.

How we will recruit the great team for our new IPO and after services?

We will select the best professional and institutions to work on your IPO.

How we will select the underwriter?

The more your company has positive reputation the better will be the negotiations with underwriters. Therefore we do suggest foreign companies to build reputation first such as starting doing active business in the U.S first.

How can I build a positive reputation in the U.S before going public?

We do suggest many companies starting with strategic alliances and investments

Do we need an underwriter for going public by DPO?

No

- Tax services for businesses and individuals

- Business Valuations

- Forensic Accounting

- CFO Assisting Services

- IFRS Reporting Services

- QuickBooks Services

- Mergers & Acquisitions Advisory services

- Initial and Direct Public Offering Assistance

- Direct Public Offering Assistance

- Due Diligence Review

- Company representation in U.S

- Company set up

- Distributor set up

- U.S Based Ecommerce

- Bids and contracts

- U.S Strategic Partnering

- Sales office and Representative set up

- Legal Services

- U.S Investment incentives

- Ware house and Shipping services

- Intellectual Property Services

- Franchising & Branch openings

Return to US Market Entry Solutions