As well as getting your firm the best possible incentives for your U.S investment you can also take advantage of our management, operations and sales consulting. Our mostly fixed priced services will boost your company’s reputation and deliver positive results.

As well as getting your firm the best possible incentives for your U.S investment you can also take advantage of our management, operations and sales consulting. Our mostly fixed priced services will boost your company’s reputation and deliver positive results.

In order to be successful globally we strongly suggest to have your presence in U.S where the birth place to world’s largest global corporations such as Wall Mart, Exxon Mobil, Coca Cola and etc. starting from a small store to be the world’s largest.

![]()

We dedicate an office in U.S until all the incentives offers collected sending proposals and meeting when necessary with local state and federal governments

- identifying the opportunities with free trade zones

- incentive compliance by our staff

- reporting the collected incentive offers back to your company board.

- Creating an Economic and Fiscal Impact Analysis

- making the final negotiations before receiving the final offer from the government agencies

- screening and consulting your company board to decide the state of investment

Advantages

Advantages for Investing in U.S

- World’s Highest per employee production rate

- Well qualified workers, engineers, and management employees

- On time access to new industry trends and technology advancements

- Doing business at the center of the world trade

- Financing solutions for your investment

- Tax incentives

- When going public to be traded at New York Stock exchange

- Free of charge assist by the Government agencies before and after your investment.

- Competitive energy rates versus to other countries

- Easy access to other International Markets

- Leader in protecting your Intellectual Property Rights

Capabilities

Our services include:

- Joint ventures

- U.S company acquisitions

- Outsourcing

- Legal Counseling

- Global E-Commerce Solutions

- Distributor & dealer set up in U.S

- Franchising

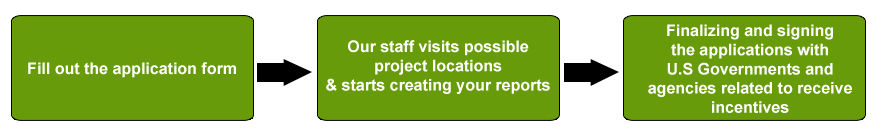

How It Works

FAQs

Q: Can I start getting my own incentives without using your office?

A-Getting incentives especially from another country where you have different time zones can be stressful especially when you need to meet with authorities and gather all the reports while you are doing your existing daily projects in your country. We strongly advise you to use Agents or consultants for you.

Q: How we will be making the payments because the process seem at least more than 6 months.

A-You can make partial payments as we process with the project.

Q: Can I attend any possible important meeting with U.S authorities with your staff?

A-Yes

Q: Why the incentive services price is break down to two one for starting and the other one for structuring the deal and negotiation

The reason for that is some companies need basic information first in order to make investment decision and some companies have already made the decision of investing so if you have are not sure yet about which country to invest only sign up for starter package first.

Q: Some countries have lower wages for employees! Why would I invest in a country that wages are higher?

Labor rates are increasing Because of the emerging global markets in other candidate country for your investment while U.S labor rates are staying the same. We do anticipate that in 10 years the gap will close dramatically. But taking into consideration that you will manufacture in a country with more than 300 million people population and better reputation in other markets by being as a U.S manufacturer

Q: How will I get work permits for my qualified staff?

The purposes of U.S incentives are to create jobs first so there for only qualified employees can apply for work visas rather than management personnel (qualified means you have applied to labor department and there were no candidates)

Q: Can I finance my investment through the U.S banks?

A-You can, once you provide the collaterals in your home country and if any in U.S along with last 5 years of financial reports you are eligible to apply for financing through multiple channels. As well government sources available.

Q: How will I pay my U.S income taxes and will I pay income taxes in my country as well?

Your U.S Company will be subject to paying taxes and income taxes as any other Company in the U.S

but if you transfer any funds to your country, your countries tax officials may tax it which generates double taxation we do suggest instead of taking transferring founds as company profits invest more in the U.S or finance your global operations and other investments from the U.S Profits.

Q: What will be my Companies exit strategy when my investment start failing or I bankrupt?

If you decide to close the operations we suggest you to work with the Bankruptcy Lawyer whom will work with bankruptcy court of the State that your company is located. This way your investment can have maximum protection for all possible law suits.

Q: Can I also do an IPO for My U.S Company?

In order to make an IPO at NYSEC or NASDAQ you do not have to be a U.S company but after opening your U.S Company will bring positive synergies to your new IPO if you decide to make one.

Return to US Market Entry Solutions